Medicare Part D

Medicare Supplement Plan

Benefits of a Medicare Supplement Plan

When you turn 65 or are ready to retire you may think that Medicare cover all of your medical costs for the rest of your life. Medicare does cover MOST of your medical costs but not all. Medicare has a rather large hospital deductible and pays only 80% of your Doctor and outpatient costs. This is way you should get a quote on a Medicare supplement plan. A Medicare supplement plan can pay these costs and leave you with very little out of pocket expense.

There are NO networks with Medicare Supplement Plans

People will love the fact that Medicare supplement plans have NO network of doctors or hospitals. You can choose to see any doctor or go to any hospital that accepts Medicare - ANYWHERE in the USA.

Lower Rates

A Medicare supplement plan will likely cost much less than you may think. Most people that enter Medicare and have been paying for their own private insurance will see a significant reduction in premium.

Covers Most of What Medicare Does Not Cover

Medicare will only pay out a certain percentage for each of the bills you get. Typically, this amount is at the eighty percent mark. This leaves you responsible for twenty percent. This may not seem like a big exposure but the issue is there is no Stop or Out of Pocket Maximum. If you have a $10,000 claim you would be responsible for $2,000 but if you have a $100,000 claim you would be responsible for $20,000. This is way the majority of folks get a Medicare supplement plan. To cover those out of pocket expenses.

No Medical Questions

During you initial Open Enrollment Period you can choose any Medicare

supplement plan you like and cannot be turned down. Once you have been

in Medicare for more than 6 mounts you can change plans but would have

to go through medical underwriting.

Having a Medicare supplement plan keeps thing simple and gives piece of

mind when it comes to medical expenses. We would be happy to help you

understand your choices and are always here to answer any questions.

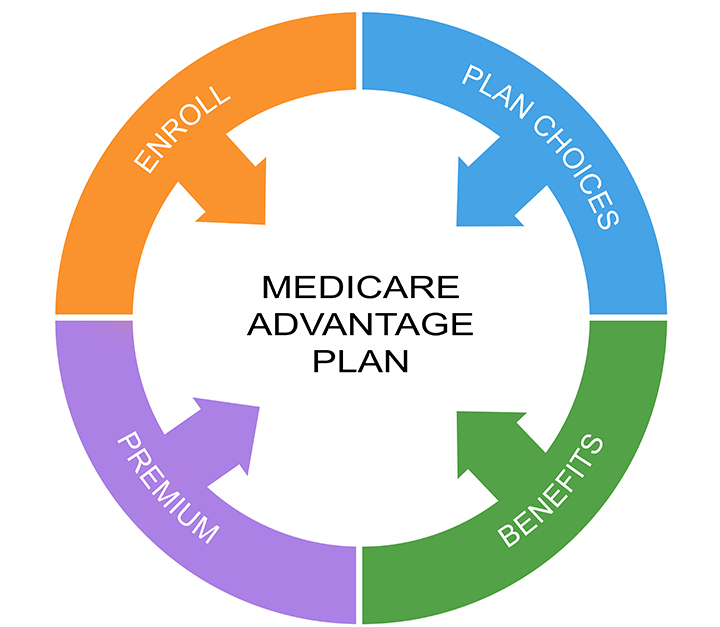

What is Medicare Advantage?

A Medicare Advantage plan is a private health insurance plan approved by Medicare. You may opt to get your Part A,B and D benefits from a Medicare Advantage plan instead of traditional Medicare. These Medicare private insurance plans usually have an HMO or PPO network of doctors.

Medicare Advantage Explained

Medicare Advantage plans were created as an alternative to Original

Medicare and Medigap. By joining one of these plans, you direct

Medicare to pay the Advantage plans a set monthly amount for your

care. In return, the plan will deliver all of your Part A & Part B

services. They take on all of your medical risk.

You must continue to pay your Medicare Part B premium while enrolled

in an Advantage plan. Yuo must be enrolled in both Medicare Part A

and B and live in the plan's service area.

Medicare Advantage policies are NOT Medigap plans. They work

differently because they pay instead od Medicare, not after

Medicare.

Medicare Advantage Coverage

Many people new to Medicare will ask us for pros and cons of Medicare

Advantage plans vs Original Medicare. Much of this is in the way you

access your benefits.

With Original Medicare, you will have deductibles and 20% coinsurance on

Part B. You can visit any dictor or hospital that participates in

Medicare, and most do.

With an Advantage plans, you will use the plan's network of providers,

which is usually local. Yuo will pay co-payments when you receive

healthcare services. Each plan sets its own cost-sharing. For example.

you might pay a small copay for a primary care doctor visit, and perhaps

a higher copay to see a specialist. Likewise, some plans will charge you

a daily hospital copay, and other plans might charge a flat amount for

the whole stay.

Perhaps one of the biggest differences is in changes to the plans.

Medicare may have small changes ti the Part A and B deductible, but the

20% coverage on outpatient services never changes. Part C Medicare

Advantage plans change annually.

Medicare itself states: Limitations, copayments and restrictions may

apply, and plan's benefits, formulary, pharmacy network provider

network, premium and copayments may change on January 1 of each year.

Members heed to be diligent about reviewing the plan materials sent to

them each year in September to see what's changing.

Medication Part D basics

Medicare Part D, the prescription drug benefit, is the part of Medicare

that covers most outpatient prescription drugs. Part D is offered

through private companies either as a stand-alone plan, for those

enrolled in Original Medicare, or as a set of benefits included with

your Medicare Advantage Plan.

Unless you have creditable drug coverage and will have a Special

Enrollment Period, you should enroll in Part D when you first get

Medicare. If you delay enrollment, you may face gaps in coverage and

enrollment penalties.

Each Part D plan has a list of covered drugs, called its formulary. If

your drug is not on the formulary, you may have to request an exception,

pay out of pocket, or file an appeal.

A drug category is a group of drugs that treat the same symptoms or have

similar effects on the body. All Part D plans must include at least two

drugs from most categories and must cover all drugs available in the

following categories:

- HIV/AIDS treatments

- Antidepressants

- Antipsychotic medications

- Anticonvulsive treatments for seizure disorders

- Immunosuppressant drugs

- Anticancer drugs (unless covered by Part B)

Part D plans must also cover most vaccines, except for vaccines covered by Part B.

Some drugs are explicitly excluded from Medicare coverage by law, including drugs used to treat weight loss or gain, and over-the-counter drugs.